UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ¨ Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement | |||

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||

| x | Definitive Proxy Statement | |||

| ¨ | Definitive Additional Materials | |||

| ¨ | Soliciting Material under Rule 14a-12 | |||

| FEDERAL REALTY INVESTMENT TRUST | ||||

| (Name of registrant as specified in its charter) | ||||

| (Name of person(s) filing proxy statement, if other than the registrant) | ||||

| Payment of Filing Fee (Check the appropriate box): | ||||

| ¨ | No fee required | |||

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11 | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| ||||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| ||||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| ||||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| ||||

| (5) | Total fee paid: | |||

| ||||

| ¨ | Fee paid previously with preliminary materials. | |||

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

| |||

| ||||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| ||||

| (3) | Filing Party:

| |||

| ||||

| (4) | Date Filed:

| |||

| ||||

March 22, 201327, 2015

Dear Shareholder:

Please accept our invitation to attend our Annual Meeting of Shareholders on Wednesday, May 1, 20136, 2015 at 10:00 a.m. This year’s meeting will be held at Fox Hill ClubAMP by Strathmore located at the Trust’s Pike & Residences, 8300 Burdette Road,Rose property, 11810 Grand Park Avenue, North Bethesda, Maryland.

The business to be conducted at the meeting is described in the formal notice that follows. In addition, management will provide a review of 20122014 operating results and discuss the outlook for the future. After the formal presentation, our Trustees and management will be available to answer any questions you may have.

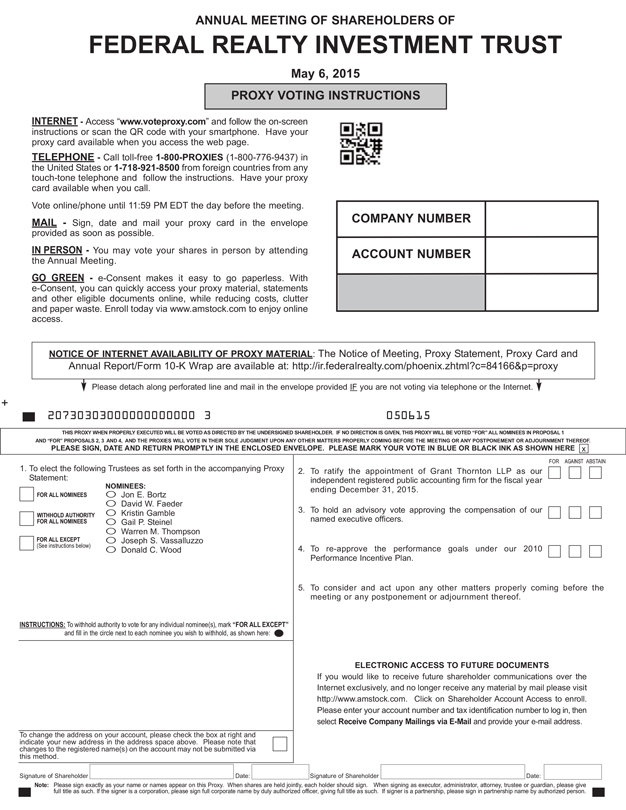

You may vote by mail by completing, signing and returning the enclosed proxy card. You also may vote either by telephone (1-800-PROXIES or 1-800-776-9437) or on the Internet (www.voteproxy.com) by following the instructions on your proxy card. We also encourage you to read the section titled “How may “registered” shareholders and shareholders holding Shares in “street name” elect to receive future shareholder materials electronically” included in this proxy statement. This section provides information on how to receive future shareholder materials, including proxy materials and annual reports, electronically either through e-mail or by accessing the Internet rather than by mail. These online services not only allow you to access these materials more quickly than ever before, but help us reduce printing and postage costs and be more environmentally friendly while decreasing the amount of paper delivered to your home.

Your vote is important and we urge you to vote by one of the three methods mentioned above.

We look forward to seeing you on May 1.6.

Sincerely,

|  | |

| Joseph S. Vassalluzzo | Donald C. Wood | |

Non-Executive Chairman of the Board | President and Chief Executive Officer |

FEDERAL REALTY INVESTMENT TRUST

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD MAY 1, 20136, 2015

To Our Shareholders:

The 20132015 Annual Meeting of Shareholders of Federal Realty Investment Trust (the “Trust”) will be held at Fox Hill Club & Residences, 8300 Burdette Road,AMP by Strathmore located at11810 Grand Park Avenue, North Bethesda, Maryland, on Wednesday, May 1, 2013,6, 2015, at 10:00 a.m. for the purpose of considering and acting upon the following:

| 1. | The election of seven Trustees to serve until our |

| 2. | The ratification of the appointment of Grant Thornton LLP as our independent registered public accounting firm for the fiscal year ending December 31, |

| 3. | An advisory vote approving the compensation of our named executive officers. |

| 4. | The re-approval of performance goals under our 2010 Performance Incentive Plan. |

| 5. | The transaction of such other business as may properly come before the Annual Meeting or any adjournment. |

Shareholders of record at the close of business on March 14, 201320, 2015 are entitled to notice of and to vote at the Annual Meeting.

For the Trustees:

Dawn M. Becker

Executive Vice President—General

Counsel and Secretary

Your vote is important. Even if you plan to attend the meeting, please vote by completing, signing and returning the enclosed proxy card by mail, by telephone (1-800-PROXIES or 1-800-776-9437) or on the Internet (www.voteproxy.com) by following the instructions on your proxy card.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE SHAREHOLDER MEETING TO BE HELD ON MAY 1, 20136, 2015

The 20132015 Proxy Statement and 20122014 Annual Report to Shareholders, which includes our Annual Report on Form 10-K for the year ended December 31, 2012,2014, are available at www.federalrealty.com.

| Page | ||||

| 28 | ||||

| 29 | ||||

Deductibility of Executive Compensation in Excess of $1.0 Million | 29 | |||

| 30 | ||||

| 32 | ||||

| 32 | ||||

| 33 | ||||

| 33 | ||||

Potential Payments on Termination of Employment and Change-in-Control | 34 | |||

Item 3—Advisory Vote on the Compensation of our Named Executive Officers | 37 | |||

Item 4—Re-Approval of Performance Goals under our 2010 Performance Incentive Plan | 38 | |||

Solicitation of Proxies, Shareholder Proposals and Other Matters | ||||

FEDERAL REALTY INVESTMENT TRUST

1626 East Jefferson Street, Rockville, Maryland 20852

PROXY STATEMENT

March 15, 201321, 2015

We are providing these proxy materials in connection with the 20132015 Annual Meeting of Shareholders (“Annual Meeting”) of Federal Realty Investment Trust (the “Trust”). These materials will assist you in voting your common shares of beneficial interest of the Trust (“Shares”) by providing information on matters that will be presented at the Annual Meeting.

The Board of Trustees (the “Board” or “Board of Trustees”) of the Trust is soliciting your proxy to vote on matters that will be presented at our Annual Meeting.

When will the Annual Meeting take place?

The Annual Meeting will be held at 10:00 a.m. EDT, Wednesday, May 1, 2013,6, 2015, at Fox Hill Club & Residences, 8300 Burdette Road,AMP by Strathmore, 11810 Grand Park Avenue, North Bethesda, Maryland.

What is the purpose of the Annual Meeting?

To vote on the following matters:

The election of seven Trustees to serve until our 20142016 Annual Meeting of Shareholders;

The ratification of the appointment of Grant Thornton LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2013;2015;

An advisory vote approving the compensation of our named executive officers;

The re-approval of performance goals under our 2010 Performance Incentive Plan (the “2010 Plan”); and

The transaction of such other business as may properly come before the Annual Meeting or any adjournment.

What are the Board’s recommendations?

The Board recommends a vote:

FOR the election of each of the seven Trustees to serve until our 20142016 Annual Meeting;

FOR the ratification of the appointment of Grant Thornton LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2013;2015;

FOR the approval of the compensation of our named executive officers; and

FOR or AGAINST other matters that come before the Annual meeting, asre-approval of the performance goals under our proxies deem advisable.2010 Plan.

Why am I receiving these proxy materials?

You are receiving these materials because you owned our Shares as a “registered” shareholder or you held Shares in “street name” at the close of business on the record date for the Annual Meeting.

What is the difference between a “registered” shareholder and holding Shares in “street name?”

If your Shares are registered directly in your name with American Stock Transfer and Trust Company, our transfer agent, you are a “registered” shareholder. If you own Shares through a broker, bank, trust or other nominee rather than in your own name, you are the beneficial owner of the Shares, but considered to be holding the Shares in “street name.”

Why did I receive a “Notice of Internet Availability of Proxy Materials” in the mail regarding the Internet availability of proxy materials instead of a paper copy of proxy materials?

As permitted by the Securities and Exchange Commission (“SEC”), we are furnishing proxy materials including this proxy statement and our 20122014 Annual Report to Shareholders, which includes our Annual Report on Form 10-K for the year ended December 31, 2012,2014, to our shareholders who hold their Shares in “street name” by providing access to such documents on the Internet instead of mailing printed copies. A “Notice of Internet Availability of Proxy Materials” (“Notice”) describes how to access and review our proxy materials online, how to submit your vote online and how to request a printed copy of our proxy materials. The Notice is being mailed to our shareholders who hold their Shares in “street name” on or about March 22, 2013.27, 2015.

Can I vote my Shares by filling out and returning the Notice?

No. The Notice identifies the items to be voted on at the Annual Meeting, but you cannot vote by marking the Notice and returning it. The Notice provides instructions on how to vote by (i) Internet, (ii) telephone, (iii) requesting and returning a paper proxy card or voting instruction form; or (iv) submitting a ballot in person at the meeting.

Why did I receive a paper copy of the proxy materials?

This proxy statement, the accompanying proxy card and our 20122014 Annual Report to Shareholders, which includes our Annual Report on Form 10-K for the year ended December 31, 2012,2014, are being mailed to our “registered” shareholders on or about March 26, 2013April 1, 2015 who have not elected to receive proxy materials electronically.

How may “registered” shareholders and shareholders holding Shares in “street name” elect to receive future shareholder materials electronically?

Opting to receive all future proxy materials electronically saves us the cost of producing and mailing documents to your home or business and helps us to conserve natural resources. “Registered” shareholders who wish to receive their proxy materials electronically rather than by mail may register to do so on American Stock Transfer & Trust Company’s website atwww.amstock.com. “Registered” shareholders who choose to receive future proxy materials electronically will receive an email containing links to our proxy materials. “Registered” shareholders who hold Shares in different ways (i.e., joint tenancy, trusts, custodial accounts) or in multiple accounts will need to complete this process for each account. Your election to receive your proxy materials by electronic email delivery will remain in effect for all future annual meetings until you revoke it.

If you own Shares in “street name” and wish to receive your proxy materials electronically via an email containing links to our proxy materials, you must contact your broker, bank, trust or nominee for instructions on how to receive future proxy materials in this manner. Shareholders who hold Shares in “street name” in different ways (i.e., joint tenancy, trusts, custodial accounts) or in multiple accounts will need to complete this process for each account. Your election to receive your proxy materials by electronic email delivery will remain in effect for all future annual meetings until you revoke it.

Who is entitled to vote at the Annual Meeting?

The Board established March 14, 201320, 2015 as the record date for the Annual Meeting. Holders who owned our Shares at the close of business on that date are entitled to receive notice of and may attend and vote at the Annual

Meeting or any postponements or adjournments of the meeting. We had 65,238,93068,677,816 Shares outstanding on March 14, 2013.20, 2015.

How many votes must be present to hold the Annual Meeting?

A quorum is required for our shareholders to conduct business at the Annual Meeting. A quorum occurs when a majority of the Shares entitled to vote at the Annual Meeting are present in person or by proxy. Properly executed proxy cards marked “for,” “against”, “withhold” or “abstain” and broker “non-votes” will be counted as present at the Annual Meeting for purposes of determining a quorum.

As to each item, you are entitled to cast one vote per Share; however, as to the election of Trustees, you are entitled to cast one vote per Share for each of the seven open trustee positions. The proxy card indicates the number of Shares you owned on the record date.

What if I don’t vote my Shares?

If you do not vote your Shares, your Shares will not be counted for purposes of determining a quorum or for determining whether the matters presented at the meeting are approved.

What if I return my proxy card but don’t give specific voting instructions?

If you are a “registered” shareholder and you sign and return your proxy card without indicating how you want your Shares to be voted, Dawn M. Becker and James M. Taylor, Jr. will vote your Shares in accordance with the recommendations of the Board. If you own Shares in “street name,” you must give your broker, bank, trust or nominee specific instructions on how to vote your Shares with respect to Items 1, 3 and 3.4. If you fail to give your broker, bank, trust or nominee specific instructions on how to vote your Shares on those matters, your vote will NOT be counted for those matters. It is important for every shareholder’s vote to be counted on these matters so we encourage you to provide your broker, bank, trust or nominee with voting instructions. If you fail to give your broker, bank, trust or nominee specific instructions on how to vote your Shares on Item 2, such broker, bank, trust or nominee will generally be able to vote on Item 2 as he, she or it determines.

A proxy is your legal designation of another person (the “proxy”) to vote your Shares on your behalf. By completing and returning the enclosed proxy card, you are giving Dawn M. Becker and James M. Taylor, Jr. the authority to vote your Shares in the manner you indicate on your proxy card.

What if I return my proxy card but abstain?

Abstentions are counted as present for determining a quorum; however, abstentions will have no effect on any of the items to be considered at the Annual Meeting.

May I change my vote after I return my proxy card?

Yes. A proxy may be revoked by a “registered” shareholder at any time before it is exercised at the Annual Meeting by submitting a proxy bearing a later date or by voting in person at the Annual Meeting. If you hold your Shares in “street name,” you must contact your broker, bank, trust or other nominee to determine how to revoke your original proxy. In general, submitting a subsequent proxy executed by the party that executed the original proxy will revoke the earlier proxy.

Why did I receive more than one Notice, proxy card, voting instruction form and/or email?

You will receive more than one Notice, proxy card, voting instruction form or email, or any combination of these if you hold your Shares in different ways (i.e., joint tenancy, trusts, custodial accounts) or in multiple

accounts. You should provide voting instructions for all Notices, proxy cards, voting instruction forms and email links you receive.

Are there other matters to be acted upon at the Annual Meeting?

The Trust does not know of any matter to be presented at the Annual Meeting other than those described in the proxy statement. If, however, other matters are properly presented for action at the Annual Meeting, Dawn M. Becker and James M. Taylor, Jr. will have the discretion to vote on such matters in accordance with their best judgment.

Who is paying for the solicitation of proxies?

The cost of this solicitation of proxies will be borne by us. In addition to the use of the mail, we may solicit proxies in person and by telephone or facsimile, and may request brokerage houses and other custodians, nominees and fiduciaries to forward soliciting materials to the beneficial owners of Shares and reimburse them for their reasonable expenses. We may also hire a proxy solicitation firm at a standard industry compensation rate.

What if I have questions about the Notice, voting or electronic delivery?

Questions regarding the Notice, voting or electronic delivery should be directed to our Investor Relations Department at (800) 937-5449 or by email atIR@federalrealty.com.

Who are the largest owners of Shares?

Based upon our records and the information reported in filings with the SEC, the following were beneficial owners of more than 5% of our Shares as of March 14, 2013:20, 2015:

Name and Address of Beneficial Owner | Amount and Nature of Beneficial Ownership | Percentage of Our Outstanding Shares (1) | ||||||

The Vanguard Group, Inc.(2) 100 Vanguard Blvd. Malvern, PA 19355 | 7,441,477 | 11.4 | % | |||||

BlackRock, Inc.(3) 40 East 52nd Street New York, NY 10022 | 6,645,506 | 10.2 | % | |||||

State Street Corporation(4) State Street Financial Center One Lincoln Street Boston, MA 02111 | 4,348,637 | 6.7 | % | |||||

Vanguard Specialized Funds – Vanguard REIT Index Fund(5) 100 Vanguard Blvd. Malvern, PA 19355 | 4,244,034 | 6.5 | % | |||||

Cohen & Steers, Inc.(6) 280 Park Avenue, 10th Floor New York, NY 10017 | 3,951,671 | 6.0 | % | |||||

Name and Address of Beneficial Owner | Amount and Nature of Beneficial Ownership | Percentage of Our Outstanding Shares (1) | ||||||

The Vanguard Group, Inc.(2) 100 Vanguard Blvd. Malvern, PA 19355 | 9,409,418 | 13.7 | % | |||||

BlackRock, Inc.(3) 55 East 52nd Street New York, NY 10022 | 7,578,057 | 11.0 | % | |||||

Vanguard Specialized Funds – Vanguard REIT Index Fund(4) 100 Vanguard Blvd. Malvern, PA 19355 | 5,026,726 | 7.3 | % | |||||

State Street Corporation(5) State Street Financial Center One Lincoln Street Boston, MA 02111 | 4,287,498 | 6.2 | % | |||||

Invesco Ltd.(6) 1555 Peachtree Street NE Atlanta, GA 30309 | 3,803,940 | 5.5 | % | |||||

| (1) | The percentage of outstanding Shares is calculated by taking the number of Shares stated in the Schedule 13G or 13G/A, as applicable, filed with the SEC divided by |

| (2) | Information based on a Schedule 13G/A filed with the SEC on February |

| power over |

| (3) | Information based on a Schedule 13G/A filed with the SEC on January |

| (4) |

| Information based on a Schedule 13G/A filed with the SEC on February |

| (5) | Information based on a Schedule 13G filed with the SEC on February 12, 2015 by State Street Corporation, which states State Street Corporation, a parent holding company, has shared voting and dispositive power over 4,287,498 Shares. The Schedule 13G also states that State Street Corporation’s subsidiaries are State Street Global Advisors France S.A., SSGA Funds Management, Inc., State Street Global Advisors Limited, State Street Global Advisors Ltd., State Street Global Advisors, Australia Limited, State Street Global Advisors Japan Co., Ltd. and State Street Global Advisors, Asia Limited, each an investment advisor and State Street Bank and Trust Company, a bank. |

| (6) | Information based on a Schedule |

How many Shares do our Trustees and executive officers own?

As of March 14, 2013,20, 2015, our Trustees and executive officers, both individually and collectively, beneficially owned the Shares reflected in the table below. The number of Shares shown in this table reflects beneficial ownership determined in accordance with Rule 13d-3 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) and, therefore, includes unvested Shares and Shares that have not been issued but as to which options are outstanding and may be exercised within 60 days of the date of this proxy statement. Except as noted in the footnotes that follow the table, each Trustee and executive officer has sole voting and investment power as to all Shares listed. Fractional Shares have been rounded to the nearest full Share.Share.

| Name and Address of Beneficial Owner (1) | Common | Unvested Restricted Shares | Options Currently Exercisable or Exercisable Within 60 Days | Total Shares Beneficially Owned | Percentage of Outstanding Shares Owned (2) | Common | Unvested Restricted Shares | Options Currently Exercisable or Exercisable Within 60 Days | Total Shares | Percentage of Outstanding Shares Owned (2) | ||||||||||||||||||||||||||||||

Dawn M. Becker | 75,687 | 20,459 | 48,144 | 144,290 | * | 94,810 | 14,401 | 39,941 | 149,152 | * | ||||||||||||||||||||||||||||||

Andrew P. Blocher(3) | 12,463 | 0 | 0 | 12,463 | * | |||||||||||||||||||||||||||||||||||

Jon E. Bortz(4) | 5,769 | 0 | 0 | 5,769 | * | |||||||||||||||||||||||||||||||||||

Jon E. Bortz(3) | 7,343 | 0 | 0 | 7,343 | * | |||||||||||||||||||||||||||||||||||

David W. Faeder | 5,326 | 0 | 0 | 5,326 | * | 7,000 | 0 | 0 | 7,000 | * | ||||||||||||||||||||||||||||||

Kristin Gamble(5) | 27,781 | 0 | 0 | 27,781 | * | |||||||||||||||||||||||||||||||||||

Kristin Gamble(4) | 28,928 | 0 | 0 | 28,928 | * | |||||||||||||||||||||||||||||||||||

Gail P. Steinel | 5,122 | 0 | 0 | 5,122 | * | 6,796 | 0 | 0 | 6,796 | * | ||||||||||||||||||||||||||||||

James M. Taylor, Jr. | 4,612 | 9,186 | 0 | 13,798 | * | 10,686 | 17,237 | 0 | 27,923 | * | ||||||||||||||||||||||||||||||

Warren M. Thompson | 5,201 | 0 | 0 | 5,201 | * | 6,875 | 0 | 0 | 6,875 | * | ||||||||||||||||||||||||||||||

Joseph S. Vassalluzzo | 15,315 | 0 | 0 | 15,315 | * | 17,918 | 0 | 0 | 17,918 | * | ||||||||||||||||||||||||||||||

Donald C. Wood(6) | 188,842 | 180,564 | 219,038 | 588,444 | * | |||||||||||||||||||||||||||||||||||

Trustees, trustee nominees and executive officers as a group (9 individuals)(7) | 333,655 | 210,209 | 267,182 | 811,046 | 1.2 | % | ||||||||||||||||||||||||||||||||||

Donald C. Wood(5) | 198,550 | 143,067 | 247,996 | 589,613 | * | |||||||||||||||||||||||||||||||||||

Trustees, trustee nominees and executive officers as a group (9 individuals) | 378,906 | 174,705 | 287,937 | 841,548 | 1.2 | % | ||||||||||||||||||||||||||||||||||

| * | Less than 1% |

| (1) | Unless otherwise indicated, the address of each beneficial owner is 1626 East Jefferson Street, Rockville, MD 20852. |

| (2) | The percentage of outstanding Shares owned is calculated by taking the number of Shares reflected in the column titled “Total Shares Beneficially Owned” divided by |

| (3) |

| Includes 19,335 Shares as to which Ms. Gamble shares investment power for clients. Includes 1,400 Shares as to which Ms. Gamble is a trustee of a profit sharing plan, of which Ms. Gamble has a direct interest in 581 Shares and of which 581 Shares are owned by Ms. Gamble’s husband. |

| Includes 53,879 Shares owned by Mr. Wood’s wife. |

Article III, Section 1 of our Bylaws provides that no more than one of our Trustees can fail to qualify as independent under the requirements of the New York Stock Exchange (“NYSE”), the SEC, our Corporate Governance Guidelines and other applicable rules and regulations. At its first quarterly meeting each calendar year, the Board reviews all relationships between us and each Trustee to determine whether each Trustee is independent under all applicable requirements. That review includes a determination of whether there are any material relationships between us and the Trustee which, in the opinion of the Board, adversely affect the Trustee’s ability to exercise independent judgment as a trustee. The Board also considers independence on an ongoing basis throughout the year if there are any changes in circumstances that could impact a Trustee’s independence.

The Board, on recommendation of the Nominating and Corporate Governance Committee, and after considering all relevant facts and circumstances, determined in each of February 20122014 and February 20132015 that, except for Mr. Wood, the Trust’s Chief Executive Officer, each Trustee then serving on the Board satisfied all applicable requirements to be considered independent. In making that determination, the Board concluded that a Trustee’s position as a director of a company with which we do business does not constitute a material relationship so long as payments made by that company do not account for more than five percent (5%) of our gross revenues or more than ten percent (10%) of the gross revenues of that company. This standard is set forth in our Corporate Governance Guidelines. Further, the Board has concluded that except for Mr. Wood, who is an employee of the Trust, there are no relationships, material or otherwise, between us and any of the Trustees except as described below. All of these relationships were considered by the Board in making its determination that all Trustees other than Mr. Wood are independent. The specific relationships considered by the Board in

making its independence determinations were the following, which includes all of those relationships described in the “Certain Relationships and Related Transactions” section below:

| Name | Affiliated Company/Position | Relationship (1) | ||

Jon E. Bortz | Chief Executive Officer and Chairman of the Board of Trustees of Pebblebrook Hotel Trust | owns hotels we a conferences and business trips for various employees in 2013 and 2014 | ||

David W. Faeder | None | • None | ||

Kristin Gamble | Director of Ethan Allen Interiors, Inc. | • Ethan Allen location from us totaling 12,900 square feet, until the 2014 | ||

Gail P. Steinel | None | • None | ||

Warren M. Thompson | President and Chairman of the Board of Directors of Thompson Hospitality Corporation | • Wholly owned subsidiaries of Thompson Hospitality Corporation (collectively “THC”) lease 4 locations from us totaling 23,855 square feet • In 2012 we entered into a | ||

Joseph S. Vassalluzzo | Director of | subsidiary, Office Max, collectively leased 8 locations totaling 170,572 square feet, until 1 location another location expired September 30, 2014 | ||

In no instance did the payments made to us by any tenant with which our Trustees are affiliated, or the payments made by us to Pebblebrook Hotel Trust, account for more than five percent (5%) of our gross revenues or more than ten percent (10%) of the gross revenues of any tenant or Pebblebrook Hotel Trust. Further, the payments made by us to Pebblebrook Hotel Trust accounted for less than 2% of both our and

| (1) | In no instance did the payments made by us or to us by any tenant with which our Trustees are affiliated, or the payments made by us to Pebblebrook Hotel Trust, account for more than five percent (5%) of our gross revenues or more than ten percent (10%) of the gross revenues of any tenant or Pebblebrook Hotel Trust. Further, the payments made by us to Pebblebrook Hotel Trust in each of the last three fiscal years accounted for less than 2% of both our and Pebblebrook Hotel Trust’s consolidated gross revenues for each of the last three fiscal years, and the payments made by us and to us by two of Thompson Hospitality Corporation’s wholly-owned subsidiaries collectively accounted for less than 2% of both our and Thompson Hospitality Corporation’s consolidated gross revenues for each of the last three fiscal years. |

Pebblebrook Hotel Trust’s consolidated gross revenues in 2012 and the payments made to us by two of Thompson Hospitality Corporation’s wholly-owned subsidiaries collectively accounted for less than 2% of both our and Thompson Hospitality Corporation’s consolidated gross revenues for each of the last three fiscal years.

Board of Trustees and Board Committees

The Board of Trustees discharges its responsibilities through regularly scheduled meetings as well as through telephonic meetings, action by written consent and other communications with management as appropriate. During 2012,2014, the Board of Trustees held sixfive meetings. The non-management Trustees (all of whom are independent) held four executive sessions at the meetings that were open for participationattended by all non-management Trustees. Mr. Vassalluzzo, the Non-Executive Chairman of the Board, presided over all Board meetings as well as all executive sessions of the non-management Trustees during 2012.2014. The Non-Executive Chairman of the Board is expected to preside over all future Board meetings and executive sessions of non-management Trustees. Since 2003, we have operated under a governance structure where the Chairman of the Board and Chief Executive Officer are separate positions held by different individuals. At its meetings in February 20122014 and 2013,2015, the Board discussed whether this structure was still the best structure for us and concluded that it was. Having the Board operate under the leadership and direction of someone independent from management provides the Board with the most appropriate mechanism to fulfill its oversight responsibilities and hold management accountable for the performance of the Trust. It also allows our Chief Executive Officer to focus his time on running our day-to-day business. The Board believes that one of the most important attributes for the Board is independence from management and that belief has been reflected in the separation of the chairman and CEO roles as well as in our Corporate Governance Guidelines which permit no more than one member of the Board to be a non-independent trustee.

Each of the Trustees attended at least 75% of all meetings of the Board and the Board committees on which each Trustee served during 2012.2014. On an aggregate basis, the Trustees attended 96%99% of all Board and Board committee meetings on which each Trustee served in 2012.2014. Our Corporate Governance Guidelines provide that all Trustees are expected to attend all meetings of the Board and the Board committees on which he or she serves as well as the Annual Meeting of Shareholders. All Trustees attended our 20122014 Annual Meeting of Shareholders.

The Board has three standing committees which are the Audit Committee, the Compensation Committee and the Nominating and Corporate Governance Committee. Each committee operates under a written charter which is available in the Investors section of our website atwww.federalrealty.com. Each member of these committees meets, and throughout 20122014 met, the independence, experience and, with respect to the Audit Committee, the financial literacy requirements, of the NYSE, the SEC and our Corporate Governance Guidelines. The membership, primary functions and number of meetings during 20122014 for each of these standing committees are described below:

| Committee Members | Primary Responsibilities | Number of Meetings During | ||

| Audit | ||||

Gail P. Steinel* Jon E. Bortz David W. Faeder** Warren M. Thompson | • selecting the independent registered public accounting firm and approving and overseeing its work; • overseeing our financial reporting, including reviewing results with management and the independent registered public accounting firm; and • overseeing our internal systems of accounting and controls | 4 | ||

Compensation | ||||

David W. Faeder* Kristin Gamble Gail P. Steinel Joseph Vassalluzzo | • reviewing and recommending compensation for our officers; • administering our Amended and Restated 2001 Long-Term Incentive Plan (“2001 Plan”) and our 2010 • administering other benefit programs of the Trust | |||

Nominating and Corporate Governance | ||||

Warren M. Thompson* Jon E. Bortz Kristin Gamble Joseph S. Vassalluzzo | • recommending individuals to stand for election to the Board; • making recommendations regarding committee memberships; and • overseeing our corporate governance policies and procedures, including Board and Trustee evaluations | 2 | ||

| * | Denotes current chairperson of the committee |

| ** | Denotes our |

Identifying individuals to stand for election as Trustees

The Nominating and Corporate Governance Committee (the “Nominating Committee”) is responsible for identifying individuals to stand for election as Trustees. It begins the process by determining whether there are any changes that should be made to the Board in terms of size or skill sets in order for the Board to appropriately perform its responsibilities. If the Nominating Committee concludes that no changes are needed, it first reviews each of the incumbent Trustees whose terms are expiring to determine whether those individuals should be nominated for reelection to the Board. If the Nominating Committee determines that the Board should be expanded or that the incumbent Trustees whose terms are expiring should not be nominated for reelection and those positions need to be filled, the Nominating Committee will seek recommendations from other Board members for possible candidates. If no appropriate candidates are identified, the Nominating Committee will

the Committee will consider retaining a search firm. Recommendations provided by shareholders will also be considered and will be evaluated on the same basis as all other Board candidates.

The primary factors included in the Nominating Committee’s determination are whether the individual possesses skills which are desirable for the effective oversight of the Trust’s operation and complementary to the skills of the other Trustees. If the individual is an incumbent Trustee, the Nominating Committee also considers whether he or she is performing his or her responsibilities as a Trustee well and adding value to the Board and its operations as reflected on the most recent individual Trustee evaluations. All candidates for election to the Board should, at a minimum, possess public company, real estate, retail and/or other financial experience and have a history of honesty, integrity and fair dealing with third parties. The Board has no specific policy on diversity but believes that Board membership should reflect diversity in a broad sense, including, among other things, geography, gender and ethnicity. In addition, the Board specifically reviews and considers the backgrounds, experience and competencies of each Trustee nominee and Trustee to ensure that the Board reflects as a whole an appropriate diversity of knowledge, experience, skill and expertise required to enable the Board to perform its responsibilities in managing and directing our business efficiently and effectively.

Once a candidate is identified who has not previously served on the Board, the Nominating Committee arranges meetings between the candidate and Board members as well as our senior management. The Nominating Committee also undertakes whatever investigative and due diligence activities it deems necessary to verify the candidate’s credentials and determine whether the candidate would be a positive contributor to the operations of the Board and a good representative of our shareholders. Critical to this whole process is the Nominating Committee’s determination that any candidate presented to the shareholders for election to the Board satisfies all of the independence requirements imposed by the NYSE, the SEC, our Corporate Governance Guidelines and other applicable rules and regulations.

Any shareholder may propose a candidate to be nominated for election to the Board by following the procedures outlined in Article II, Section 13 of our Bylaws. Any shareholder wishing to present a candidate for consideration as a Trustee for election at the Trust’s 20142016 Annual Meeting of Shareholders must provide the Nominating Committee with the name of the shareholder proposing the candidate as well as contact information for that shareholder, the name of the individual proposed for election, a resume or similar summary that includes the individual’s qualifications and such other factual information that would be necessary or helpful for the Nominating Committee to evaluate the individual. The information should be sent to the Nominating Committee, in care of the Trust’s Secretary, by no later than November 26, 2013December 3, 2015 so that the Secretary can forward it to the Nominating Committee chair for consideration. The Nominating Committee will not have sufficient time to evaluate any candidate submitted after that date. A copy of our Bylaws may be obtained by sending a written request to Investor Relations at 1626 East Jefferson Street, Rockville, MD 20852.

Although ourthe Board has delegated to ourthe Audit Committee responsibility for overseeing our risks and exposures on an ongoing basis, the entire Board regularly receives regular updates from management on the continued viability of our business plan, market conditions, capital position, and our business results and specifically reviews potential risks from time to time. The Board reviews that information together with our quarterly and annual financial statements and operating results and short and long-term business prospects to assess the risks that we may encounter and to establish appropriate direction to avoid or minimize the potential impact of the identified risks. Some of the details that are discussed as part of the Board’s review of potential risks facing us include, without limitation: (a) the impact of market conditions on our business; (b) operational risks such as the ability of our tenants to be successful and the ability to grow the company through increasing rents and redeveloping our properties; (c) liquidity and credit risks, including our ability to access capital to run and grow our business and our overall cost of capital and the impact on our profitability; (d) investment risks from acquisitions and our development and redevelopment projects; (e) regulatory risks that may impact our profitability such as environmental laws and regulations, the Americans with Disabilities Act of 1990 and various

other federal, state and local laws; (f) REIT risks such as our failure to qualify as a REIT for federal income tax purposes; (g) cybersecurity risks; and (g)(h) general risks inherent in the real estate industry.

As part of the Board’s risk oversight function, our Compensation Committee reviewed in February 20132015 our compensation policies and practices for all of our employees to determine whether any of such policies or programs created any risk that could have a material adverse impact on us. Approximately 95% of our employees participate in compensation programs tied to either corporate performance or regionaldivisional performance necessary to achieve corporate objectives and the Compensation Committee believes that those programs do not encourage excessive and unnecessary risk taking. The Compensation Committee focused its review on the approximately 5% of our employees (11 individuals) who are compensated on a full or partial commission/bonus basis where significant portions of their annual compensation is driven by completing leasing transactions or closing acquisitions or achieving specific milestones on development projects.acquisitions. As part of that review, the Compensation Committee reviewed the internal approval processes of the Trust and determined that none of the individuals who are compensated on a transactional commission/bonus basis can complete any leasing acquisition or developmentacquisition transaction without getting approval from the Board and/or one or more members of senior management whose compensation is tied to achieving corporate objectives.

The Trustees received the following fees for their service on the Board in 2012:2014:

Annual Retainer for Non-Employee Trustees | $ | 150,000 | $ | 175,000 | ||||

Annual Retainer for Non-Executive Chairman | $ | 250,000 | $ | 250,000 | ||||

Annual Fee for Audit Committee Chairman | $ | 20,000 | $ | 20,000 | ||||

Annual Fee for Compensation Committee Chairman | $ | 10,000 | $ | 10,000 | ||||

Annual Fee for Nominating Committee Chairman | $ | 10,000 | $ | 10,000 |

Each non-employee Trustee and the Non-Executive Chairman of the Board are paid sixty percent (60%) of his/her annual retainer ($90,000105,000 for other Trustees and $150,000 for the Non-Executive Chairman of the Board) in the form of Shares. All Shares paid as part of the annual retainer vested immediately upon issuance. The equity portion of the annual retainer for 20122014 was paid in Shares on January 2, 2013.2015. The number of Shares actually received by each Trustee on January 2, 20132015 was determined by dividing the amount of the annual retainer to be paid in Shares by $104.02,$133.46, the closing price of our stock on the NYSE on December 31, 2012,2014, the last business day prior to the date the Shares were issued. The remainder of the annual retainer as well as the annual fees paid to the Chairs of the Audit, Compensation and Nominating and Corporate Governance Committees were paid in cash. Each Trustee is required to hold at all times an amount of Shares valued at least at five times the amount of the cash portion of the annual retainer. As of December 31, 2012,2014, all Trustees complied with the required level of stock ownership.

In addition to the annual retainer described above, Mr. Vassalluzzo receives administrative support for both Trust business and personal use from our regional office in Wynnewood, Pennsylvania. Except for the annual fee for serving as a Trustee, the annual fee for serving as the chair of a committee and the use of administrative support made available to Mr. Vassalluzzo, all as described above, there were no additional fees paid to any Trustee, including the Non-Executive Chairman, for service on any of the Board committees or for attendance at any Board or committee meetings.

Total compensation awarded to Trustees for service in 20122014 was as follows:

| 2012 TRUSTEE COMPENSATION TABLE | ||||||||||||||||||||||||||||||||

| 2014 TRUSTEE COMPENSATION TABLE | 2014 TRUSTEE COMPENSATION TABLE | |||||||||||||||||||||||||||||||

| Name | Fees Earned or Paid in Cash | Stock Awards | All Other Compensation | Total | Fees Earned or Paid in Cash | Stock Awards | All Other Compensation | Total | ||||||||||||||||||||||||

| ($) | ($) (1)(2) | ($) (3) | ($) | ($) | ($) (1)(2) | ($) (3) | ($) | |||||||||||||||||||||||||

Jon E. Bortz | $ | 60,000 | $ | 90,000 | $ | — | $ | 150,000 | $ | 70,000 | $ | 105,000 | $ | — | $ | 175,000 | ||||||||||||||||

David W. Faeder | $ | 70,000 | $ | 90,000 | $ | — | $ | 160,000 | $ | 80,000 | $ | 105,000 | $ | — | $ | 185,000 | ||||||||||||||||

Kristin Gamble | $ | 60,000 | $ | 90,000 | $ | — | $ | 150,000 | $ | 70,000 | $ | 105,000 | $ | — | $ | 175,000 | ||||||||||||||||

Gail P. Steinel | $ | 80,000 | $ | 90,000 | $ | — | $ | 170,000 | $ | 90,000 | $ | 105,000 | $ | — | $ | 195,000 | ||||||||||||||||

Warren M. Thompson | $ | 70,000 | $ | 90,000 | $ | — | $ | 160,000 | $ | 80,000 | $ | 105,000 | $ | — | $ | 185,000 | ||||||||||||||||

Joseph S. Vassalluzzo | $ | 100,000 | $ | 150,000 | $ | 5,361 | $ | 255,361 | $ | 100,000 | $ | 150,000 | $ | 6,300 | $ | 256,300 | ||||||||||||||||

|

|

|

| |||||||||||||||||||||||||||||

Total | $ | 440,000 | $ | 600,000 | $ | 5,361 | $ | 1,045,361 | $ | 490,000 | $ | 675,000 | $ | 6,300 | $ | 1,171,300 | ||||||||||||||||

| (1) | Amounts in this column reflect the aggregate grant date fair value of the stock awards calculated in accordance with the Financial Accounting Standards Board Accounting Standards Codification Topic 718, Compensation—Stock Compensation (“FASB ASC Topic 718”) for the fiscal year ended December 31, |

| (2) | As of December 31, |

| (3) | The amount in the “All Other Compensation” column represents our estimated value of the administrative services we made available to Mr. Vassalluzzo for both Trust business and personal use in our regional office in Wynnewood, Pennsylvania. We believe there is no incremental cost to us of providing this administrative support. |

Any shareholder of the Trust or any other interested party may communicate with the Board as a whole, the non-management Trustees of the Board as a group, the Non-Executive Chairman of the Board, and/or any individual Trustee by sending the communication to the Trust’s corporate offices at 1626 East Jefferson Street, Rockville, MD 20852 in care of the Trust’s Secretary. All such communication should identify the party to whom it is being sent, and any communication which indicates it is for the Board of Trustees or fails to identify a particular Trustee will be deemed to be a communication intended for the Trust’s Non-Executive Chairman of the Board. The Trust’s Secretary will promptly forward to the appropriate Trustee all communications she receives for the Board or any individual Trustee which relate to the Trust’s business, operations, financial condition, management, employees or similar matters. The Trust’s Secretary will not forward to any Trustee any advertising, solicitation or similar materials.

The Board of Trustees has adopted a Code of Ethics for senior financial officers as well as a Code of Business Conduct that applies to all of our Trustees and employees. In addition, the Board operates under Corporate Governance Guidelines. The Code of Ethics for our senior financial officers, our Code of Business Conduct and our Corporate Governance Guidelines are available in the Investors section of our website atwww.federalrealty.com.

Our Board of Trustees has seven Trustees. Section 5.2 of the Trust’s Declaration of Trust provides that all Trustees be elected at each annual meeting of shareholders. As a result, the nominees for Trustee this year will be elected to serve one-year terms until the 20142016 Annual Meeting of Shareholders. The Board, on recommendation of the Nominating and Corporate Governance Committee, approved the nomination of the following individuals, all of whom are currently serving on the Board, for election as trustees to hold office until the 20142016 Annual Meeting of Shareholders and until their successors have been duly elected and qualified:

| Name | Age | Position | Trustee Since | Age | Position | Trustee Since | ||||||||||||||

| Jon E. Bortz | 56 | Independent Trustee | 2005 | 58 | Independent Trustee | 2005 | ||||||||||||||

| David W. Faeder | 56 | Independent Trustee | 2003 | 58 | Independent Trustee | 2003 | ||||||||||||||

| Kristin Gamble | 67 | Independent Trustee | 1995 | 69 | Independent Trustee | 1995 | ||||||||||||||

| Gail P. Steinel | 56 | Independent Trustee | 2006 | 58 | Independent Trustee | 2006 | ||||||||||||||

| Warren M. Thompson | 53 | Independent Trustee | 2007 | 55 | Independent Trustee | 2007 | ||||||||||||||

| Joseph S. Vassalluzzo | 65 | Independent Trustee Non-Executive Chairman of the Board | 2002 | 67 | Independent Trustee Non-Executive Chairman of the Board | 2002 | ||||||||||||||

| Donald C. Wood | 52 | Non-Independent Trustee President and Chief Executive Officer of the Trust | 2003 | 54 | Non-Independent Trustee President and Chief Executive Officer of the Trust | 2003 | ||||||||||||||

In connection with reviewing nominees to stand for election at the 20132015 Annual Meeting of Shareholders, the Nominating Committee considered the following qualifications for each Trustee nominee:

Jon E. Bortz, President, Chief Executive Officer and Chairman of the Board of Pebblebrook Hotel Trust, a REIT that acquires and operatesinvests in upper upscale hotels in large US cities (from 2009 to the present); Chief Executive Officer and a Trustee (from 1998 to 2009), President (from 1998 to 2008) and Chairman of the Board (from 2001 to 2009) of LaSalle Hotel Properties, a multi-tenant, multi-operator hotel REIT; and various real estate related positions with Jones Lang LaSalle (from 1981 to 1998). Mr. Bortz brings to the Board public company, REIT and real estate experience. His experience as chief executive officer of LaSalle Hotel Properties and Pebblebrook Hotel Trust provide a valuable perspective for running a public real estate company while his real estate experience at Jones Lang LaSalle provides fundamental real estate experience critical to our core business.

David W. Faeder, Managing Partner of Fountain Square Properties, a diversified real estate company, since 2003; Vice Chairman (from 2000 to 2003), President (from 1997 to 2000) and Executive Vice President and Chief Financial Officer (from 1993 to 1997) of Sunrise Senior Living, Inc., a provider of senior living services in the United States, United Kingdom and Canada; and prior to that time, Vice President of Credit Suisse First Boston (formerly First Boston Corporation) from 1991 to 1993, directing the real estate advisory business for the RTC in the Washington, DC area; Vice President ofand Morgan Stanley and Company, Inc., a brokerage firm, from 1984 to 1991 specializing in real estate transactionstransactions. Director of Arlington Asset Investment Corp., a company that acquires and financings;holds mortgage-related and priorother assets, including residential mortgage-backed securities issued by U.S. government agencies or guaranteed as to that time, various other accounting positions with Ernstprincipal and Whinney, Better Homes of Virginia,U.S. government agencies or U.S. government-sponsored entities and Goodman and Company.mortgage-backed securities issued by private organizations. Mr. Faeder is a valuable member of the Board because of his public company and accounting experience, having previously served as the chief financial officer of Sunrise Senior Living, and his real estate investment experience from his time as a private real estate investor.

Kristin Gamble, President of Flood, Gamble Associates, Inc., an investment counseling firm, since 1984; and prior to that time, various management positions with responsibility for investments and investment research with brokerage firms and other financial services companies. Director of Ethan Allen Interiors Inc., a furniture manufacturer and retailer. Ms. Gamble benefits the Board through her broad financial related experience from an

investor perspective, including as President of her own investment counseling company for over 30 years, and before that, as an executive with responsibility for investments and investment research with various brokerage firms and other financial services companies.

Gail P. Steinel, Owner of Executive Advisors (from 2007 to present), which provides consulting services to chief executive officers and leadership seminars to companies. Executive Vice President with BearingPoint, Inc. (from 2002 to 2007), a management and technology consulting firm that provides application services, technology solutions and managed services to companies and government organizations with responsibility for overseeing the global commercial services business unit; global managing partner and a founding member of Arthur Andersen’s business consulting practice (from 1984 to 2002). Director of MTS Systems Corporation, a provider of mechanical test systems, material testing, fatigue testing and tensile testing equipment as well as motion simulation systems and calibration services. Ms. Steinel has over 25 years of auditing and consulting experience that provides the Board with a helpful perspective on managing risk and systems operations.

Warren M. Thompson, President and Chairman of Thompson Hospitality Corporation, a food service company that owns and operates restaurants and contract food services, since founding the company in October 1992. Mr. Thompson is the president, chairman and founder of his own private food service company, Thompson Hospitality Corporation since 1992. Mr. Thompson’s experience running restaurants owned by Thompson Hospitality provides the Board and management with a unique perspective that is shared by a large percentage of the Trust’s retail tenants.

Joseph S. Vassalluzzo, Non-Executive Chairman of the Board of Trustees since February 2006; Vice Chairman of Staples, Inc. (from 2000 to 2005), a retailer specializing in home, office, and computer products, with responsibility for overseeing domestic and international growth in its retail and commercial operations; various other officer positions with Staples’ and Staples Realty & Development, a subsidiary of Staples, Inc. (from 1997 to 2000); Director of iParty Corp., a premier multi-channel party supply and party planning company; Lead Director of Life Time Fitness, Inc., an operator of distinctive and large sports, athletic, fitness and family recreation centers.centers; Director of Office Depot, Inc., a global supplier of office products and services. Mr. Vassalluzzo’s extensive background in retail and real estate as a result of having served as an executive with Staples, expanding the real estate owned by Staples Realty & Development, a subsidiary of Staples, Inc. for over 10 years and serving on the boards of a number of retailers provides the board and management with retail and retail real estate expertise that is essential to our core business.

Donald C. Wood, President and Chief Executive Officer of the Trust since January 2003; prior to that time, various officer positions with the Trust, including President and Chief Operating Officer (from 2001 to 2003), Senior Vice President and Chief Operating Officer (from 2000 to 2001), Senior Vice President-Chief Operating Officer and Chief Financial Officer (from 1999 to 2000) and Senior Vice President-Treasurer and Chief Financial Officer (from 1998 to 1999); Chairman of the Board of the National Association of Real Estate Investment Trusts from November 2011 to November 2012; Directormember of the Real Estate Roundtable from July 2011 to July 2012;Executive Committee of the International Council of Shopping Centers since February 2014; Director of Post Properties, Inc., a developer and operator of upscale multifamily communities in the United States. Mr. Wood has been employed by the Trust for nearlyover fifteen years and serves on the Board as the sole non-independent Trustee. His tenure with the Trust and his responsibilities as chief executive officer provides the Board with familiarity and details on all aspects of the operations of the Trust.

Vote Required

The affirmative vote of a plurality of votes cast at the Annual Meeting, in person or by proxy, is required for the election of Trustees. If any Trustee does not receive at least 50% of the votes cast at the Annual Meeting, he or she must tender his or her resignation to the Chairman of the Nominating and Corporate Governance Committee within five (5) business days after certification of the vote. The Nominating and Corporate Governance Committee will promptly consider the resignation and make a recommendation to the Board of Trustees. In deciding whether to accept or reject a resignation that has been tendered, the Nominating and Corporate Governance Committee and the Board will consider such factors as they deem appropriate and

relevant which may include, among others: (a) the stated reasons why votes were withheld from the Trustee and whether those reasons can be cured; (b) the Trustee’s length of service, qualifications and contributions as a Trustee; (c) listing requirements of the NYSE, rules and regulations of the SEC and other applicable rules and regulations; (d) our Corporate Governance Guidelines; and (e) such other factors as the Nominating and Corporate Governance Committee

or the Board deems appropriate. Any rejection of a resignation may (but does not have to) be conditioned on curing the underlying reason for the withheld votes. The Board will take action on any resignation no later than sixty (60) days after the certification of the vote, and will disclose the action taken with a full explanation of the process used by the Board and the reason for its decision in a Form 8-K filed with the SEC within four (4) business days after the Board’s decision. If a Trustee’s resignation is accepted by the Board of Trustees, then the Board of Trustees may fill the resulting vacancy pursuant to our Bylaws. The Trustee who tenders his or her resignation will not participate in the recommendation of the Nominating and Corporate Governance Committee or the decision of the Board.

If you are a “registered” shareholder and fail to give any instructions on your proxy card on this matter, the proxies identified on the proxy card will vote FOR the election of the named individuals. An abstention or broker non-vote will have no effect on the outcome of the vote on this proposal. You are entitled to cast one vote per Share for each of the seven named individuals. Proxies may not be voted for more than seven individuals.

THE BOARD UNANIMOUSLY RECOMMENDS A VOTE ���FOR”“FOR” THE SEVEN NOMINEES FOR TRUSTEE.

The following Report of the Audit Committee does not constitute soliciting material and should not be deemed filed or incorporated by reference into any other Trust filing under the Securities Act of 1933 or the Exchange Act, except to the extent the Trust specifically incorporates this Report by reference therein.

Management is responsible for the financial reporting process, including the system of internal controls, for the preparation of consolidated financial statements in accordance with accounting principles generally accepted in the United States (“GAAP”) and for management’s report on internal control over financial reporting. The Trust’s independent registered public accounting firm, Grant Thornton LLP (“GT”), is responsible for auditing the consolidated financial statements and expressing an opinion on the financial statements and the effectiveness of internal control over financial reporting. The Audit Committee oversees the financial reporting process on behalf of the Board. In addition, the Audit Committee oversees the work of our internal audit function, which is providedperformed by PricewaterhouseCoopers LLP (“PwC”).

The Audit Committee meets at least quarterly and at such other times as it deems necessary or appropriate to carry out its responsibilities. The Audit Committee met four times during 2012,2014, and all four of these quarterly meetings included executive sessions with our independent accountantGT without management being present. In the course of fulfilling its oversight responsibilities, the Audit Committee met with both management and GT to review and discuss all annual and quarterly financial statements and quarterly operating results prior to their issuance. Management advised the Audit Committee that all financial statements were prepared in accordance with GAAP. The Audit Committee also discussed with GT matters required to be discussed pursuant to applicable Public Company Accounting Oversight Board audit standards, including the reasonableness of judgments and the clarity and completeness of financial disclosures.

In addition, the Audit Committee discussed with GT matters relating to its independence and has received from GT the written disclosures and letter required by applicable requirements of the Public Company Accounting Oversight Board regarding the independent accountant’s communications with the Audit Committee concerning independence, and has discussed with GT its independence.

The Audit Committee continually monitors the non-audit services provided by GT. During 2012,2014, the Audit Committee limited non-audit services primarily to income tax formreturn preparation for us and our subsidiaries and

the provision of advice on the tax impacts and structuring of acquisition and other property related transactions.

GT also performed the 20122014 audit of the financial statements of our joint venture with affiliates of a discretionary fund created and advised by ING Clarion Partners in which we own a 30% equity interest. The Audit Committee approved GT’s performing this audit only after determining that it would not adversely impact GT’s independence.

In 2012 as part of its oversight of our internal audit function, theThe Audit Committee after a lengthy interview process, engaged PwC to provide our internal audit function. Duringfunction in 2012 the Audit Committeeand continued to oversee the internal auditor’sPwC’s ongoing testing of the effectiveness of our internal controls.controls during 2014. The findings of the internal auditorPwC were reported to the Audit Committee on a quarterly basis.three times during 2014, and the Audit Committee met in executive session with PwC without management being present twice during 2014. GT, as part of its 20122014 audit of our financial statements, independently reviewed our internal controls and concluded that there were no material weaknesses.

On the basis of the reviews and discussions the Audit Committee has had with GT, our internal auditorPwC and management, the Audit Committee recommended to the Board of Trustees that the Board approve the inclusion of our audited financial statements in our Annual Report on Form 10-K for the fiscal year ended December 31, 20122014 for filing with the SEC.

Submitted by:

Gail P. Steinel, Chairperson

Jon E. Bortz

David W. Faeder

Warren M. Thompson

RELATIONSHIP WITH INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

GT has served as our independent registered public accounting firm for the years 2002 through 2012.year 2014. The Audit Committee approves in advance all fees paid to and services provided by GT. In addition, the Audit Committee has considered those services provided by GT and has determined that such services are compatible with maintaining the independence of GT. During 20122014 and 2011,2013, we retained GT to provide services in the following categories and amounts:

| 2012 | 2011 | 2014 | 2013 | |||||||||||||

Audit Fees(1) | $ | 560,400 | $ | 555,033 | $ | 591,951 | $ | 581,645 | ||||||||

Audit-Related Fees(2) | 48,381 | 21,525 | 26,763 | 56,700 | ||||||||||||

Tax Fees(3) | 197,064 | 199,396 | 238,205 | 228,584 | ||||||||||||

Other | 0 | 0 | 0 | 0 | ||||||||||||

|

|

|

| |||||||||||||

Total | $ | 805,845 | $ | 775,954 | $ | 856,919 | $ | 866,929 | ||||||||

| (1) | Audit fees include all fees and expenses for services in connection with: (a) the audit of our financial statements included in our annual reports on Form 10-K; (b) Sarbanes-Oxley Section 404 relating to our annual audit; (c) the review of the financial statements included in our quarterly reports on Form 10-Q; and (d) consents and comfort letters issued in connection with debt offerings and common stock offerings. These figures do not include |

| (2) | Audit-related fees primarily |

| (3) |

RATIFICATION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee of the Board of Trustees has retained GT as our independent registered public accounting firm for the year ending December 31, 20132015 and is asking the shareholders to ratify that selection. Our organizational documents do not require ratification of the selection of our independent registered public accounting firm; however, we are seeking ratification because we believe that it is a matter of good corporate practice to do so. If the selection of GT is not ratified, the Audit Committee may reconsider whether to retain GT. Even if the selection of GT is ratified, the Audit Committee may change the appointment of GT at any time if it determines such a change would be in the best interests of the Trust and our shareholders.

A representative of GT will be present at the Annual Meeting and will have the opportunity to make a statement and answer appropriate questions from shareholders.

The Audit Committee believes that GT is qualified to serve as our independent registered public accounting firm. GT is familiar with our affairs and financial procedures, having served as our independent accountant since June 2002. GT is registered with the Public Company Accounting Oversight Board. Pursuant to its charter, the Audit Committee must pre-approve all audit and non-audit services provided by GT. For 20132015, the Audit Committee to date has approved GT providing the following non-audit services: (a) tax planning and other consultation for purposes of structuring acquisitions, dispositions, joint ventures and other investment or financing opportunities as well as consultation associated with financial reporting matters (e.g. implementation of newly issued accounting standards) provided that the aggregate amount paid to GT for such services does not exceed $100,000; (b) issuance of comfort letters and consents in connection with capital markets transactions approved in accordance with the Trust’s policies and procedures provided that the aggregate amount paid to GT for such services does not exceed $125,000; (c) issuance of audit opinions related to acquisition audits required under Rule 3-14 of Regulation S-X provided that the aggregate amount paid to GT for such services does not exceed $75,000; and (d) a Limited Review ofagreed-upon procedures related to the Trust’s letter to the State of California Department of Environmental QualityEPA provided that the aggregate amount paid to GT for such services does not exceed $3,000, if requested by$3,150. The scope and amount of non-audit services that GT can perform in 2015 has remained relatively unchanged the State of California.last few years.

Once the pre-approved dollar limit for the applicable non-audit service has been reached, no additional services of that type can be provided by GT without further approval by the Audit Committee. The Audit Committee has concluded that GT’s providing these permissible non-audit services up to the aggregate pre-approved amounts would not compromise GT’s independence. The Audit Committee may approve GT providing additional non-audit services or services in excess of the amounts specified above if it determines that it is in our best interest and that GT’s independence would not be compromised. All audit and non-audit services provided to the Trust by GT for the 20122014 fiscal year are described in the “Relationship With Independent Registered Public Accounting Firm” section above.

In addition to the foregoing non-audit services, the Audit Committee also has approved GT performing the audit of the financial statements for our equity joint venture with affiliates of a discretionary fund created and advised by ING Clarion Partners for the fiscal yearsyear ending 2004 through 2012.December 31, 2014. We own a 30% interest in that joint venture. The Audit Committee approved GT performing this audit using the same criteria it uses for approving non-audit services. Although we do not consolidate the results of the joint venture, we do include our share of the joint venture’s results in our financial statements. The Audit Committee concluded that having GT perform the joint venture’s audit facilitates the inclusion of those results in our financial statements.

The affirmative vote of a majority of votes cast at the Annual Meeting, in person or by proxy, is required to approve the proposal to ratify the Audit Committee’s selection of GT as our independent registered public accounting firm for 2013.2015. If you fail to give any instructions on your proxy card on this matter, the proxies

identified on the proxy card will vote FOR this proposal. An “abstention” or broker “non-vote” will have no

effect on the outcome of the vote on this proposal, however, if you fail to give instructions to your broker, your broker may have authority to vote the shares for this proposal.

THE BOARD OF TRUSTEES UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE PROPOSAL TO RATIFY THE AUDIT COMMITTEE’S SELECTION OF GT AS OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR 2013.2015.

Our current named “executive“named executive officers” are:

| Name | Age | Position | ||||

Donald C. Wood | President and Chief Executive Officer | |||||

James M. Taylor, Jr. | Executive Vice President—Chief Financial Officer and Treasurer | |||||

Dawn M. Becker | Executive Vice President—Chief Operating Officer/ General Counsel and Secretary | |||||

Donald C. Wood, Information for Mr. Wood is provided above in “Item 1—Election of Trustees.”

James M. Taylor, Jr.,Executive Vice President-Chief Financial Officer and Treasurer of the Trust since August 15, 2012, with responsibility for overseeing the Trust’s capital markets, financial reporting, investor relations, corporate communications, information technology and East Coast acquisitions functions; Executive Vice President of the Trust from July 30, 2012 until August 14, 2012; and a senior managing director in the real estate investment banking division of Eastdil Secured and predecessors Wachovia Securities and First Union Securities (1998 to 2012). Prior to his career in investment banking, Mr. Taylor practiced corporate and securities law at Hunton & Williams (1994 to 1998) and worked as a senior accountant for Price Waterhouse (1988 to 1991).

Dawn M. Becker, Executive Vice President – Chief Operating Officer (since February 2010) and General Counsel and Secretary of the Trust (since April 2002), with responsibility for overseeing all of the Trust’s operations and asset management functions and the Trust’s Legal and Human Resources Departments; and prior to that time, various officer positions with the Trust, including Vice President–Real Estate and Finance Counsel (2000 to 2002).

COMPENSATION DISCUSSION AND ANALYSIS

You will be asked in Item 3 of this proxy statement to provide a non-binding, advisory vote on the compensation of our named executive officers as described in the following sections of this proxy statement. Please keep that in mind as you review the CD&A, summary compensation table, the supplemental tables and narrative disclosures that follow.

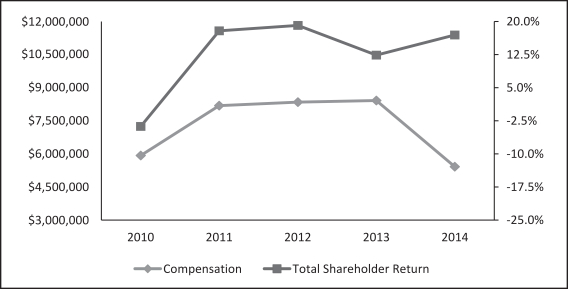

2012 was an exceptional year of performance inWe executed on all aspectsphases of our business. Onbusiness plan in 2014 with continued growth of the operating front, we delivered record levelscore portfolio through increasing rental rates and redevelopment, the opening of initial phases of new development projects and advancing the planning for additional phases of those projects, the addition of new properties to our portfolio and the continued strengthening of our balance sheet. Some of the 2014 highlights included:

Record level of gross revenue of $686.1 million, growth of 7.6% over 2013

Record level of funds from operations (both in total as well as on aavailable to common shareholders (“FFO”) of $338.1 million, growth of 11.5% over 2013 and record level of FFO per share basis)of $4.94, growth of 7.2% over 2013. Both FFO and property operating income (“POI”) and we saw strong growth from our core operating portfolio as evidenced by our year

over year same center POI growth. We also set ourselves up for future growthFFO per share have been adjusted to exclude the impact of charges associated with the early prepayment of debt in both 2013 and beyond2014. FFO is a metric commonly used by having executed moreREITs to measure performance

Signed 340 new and renewal leases for space in 2012 than ever before in our 50 year history. We signed 394 dealswhich there was a prior tenant, accounting for 1.81.5 million square feet that is expected toand generating cash basis rents 16% higher than the prior rent. These leases will generate nearly $7$7.4 million of additional rent per year which providesthan the basis for future growthprior leases

Occupancy of 94.7% as these leases come on line inof December 31, 2014

Raised $458 million of capital to fund our business plan. The new capital included $214 million of equity and the net proceeds from a year or two. We were also able$250 million 30-year senior note issuance at a 4.5% interest rate to increaserefinance maturing debt having a weighted average interest rate of 5.5%

| • | Increased our cash dividend to shareholders for the 47th consecutive year |

Opened the occupancy in our portfolio (excluding acquired properties) by nearly 330,000 square feet. These strong operating results allowed us to increase our cash dividend to shareholders for the 45th consecutive year.

| Metric | 2012 | 2011 | 2010 | |||||||||

Funds From Operations (“FFO”) | $ | 277.2 million | $ | 251.6 million | $ | 239.5 million | ||||||

Funds from Operations per Share | $ | 4.31 | $ | 4.00 | $ | 3.88 | ||||||

Property Operating Income | $ | 428.5 million | $ | 382.9 million | $ | 372.6 million | ||||||

Same Center POI Growth | 6.1 | % | 1.8 | % | 2.3 | % | ||||||

Cash Dividends Paid Per Common Share | $ | 2.80 | $ | 2.70 | $ | 2.65 | ||||||

During 2012, we broke ground on the first phaseinitial phases of each ofboth Assembly Row in Somerville, Massachusetts and Pike & Rose in Rockville,North Bethesda, Maryland and onhaving a combined investment of approximately $406 million as of December 31, 2014

Stabilized our latest phase of redevelopment at Santana Row in San Jose, California. In all,California, a 212-unit residential building in which we expect to invest more than $500invested approximately $76 million in these projects over

Commenced construction on the next 2-3 years at an expected return, on average,phase of 7%-8%Santana Row which will create significantbe a 227,000 square foot commercial building including both retail and office space as well as additional valueparking to serve the property

Acquired controlling interests in two properties totaling nearly 286,000 square feet

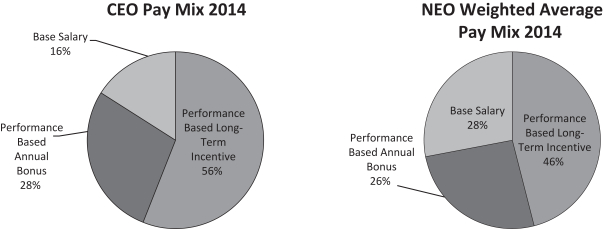

With respect to specific compensation actions in 2014, the Compensation Committee did the following:

Base Salary – made no changes to the base salaries for our shareholders over the long-term.

The strengthany of our operating performance was matched in 2012 by a further strengtheningnamed executive officers

Annual Performance Bonus Plan (“Annual Bonus Plan”) – made no changes to target levels or potential payouts for any of our balance sheet. We raised $250 millionnamed executive officers and awarded each of 10 year unsecured debt at 3% which was, atour named executive officers a full bonus as determined by the time, the lowest rate ever achieved by a real estate investment trust for a ten year security and we raised more than $90 million of equity through our at the market equity program at a net price in excess of $100 per share.Annual Bonus Plan

2012 was also a year of transition for our Chief Financial Officer

Long-Term Incentive Award Program (“CFO”LTIAP”) position. In August 2012, James Taylor replaced Andrew Blocher as our CFO. Mr. Taylor had been an outside advisor– made no changes to the Trusttarget levels or potential payouts for any of our named executive officers. However, given Mr. Taylor’s relatively short tenure with us and the desire to increase his stock holdings, the Compensation Committee advanced Mr. Taylor’s award under the LTIAP that would be made for the three year performance period ending December 31, 2014 and made that award in February 2014 instead of February 2015. In exchange for the earlier award, the vesting for this award was extended from 3 years to 5 years

Given that more than a decade and was added to the team to provide depth and experience to our ability to source and evaluate corporate business development and strategic opportunities.

Our strong and consistent performance over the past several years coupled with the visibility for future growth through our development pipeline and our prudent balance sheet management helped to push our stock price to a record level in 2012 and has resulted in strong total returns for our shareholders on both a relative and absolute basis over the past one, three and five year periods.

| Metric | 2012 Total Shareholder Return | 3 Year Total Shareholder Return through 12/31/12 | 5 Year Total Shareholder Return through 12/31/12 | |||||||||

Federal Realty | 18 | % | 69 | % | 51 | % | ||||||

Bloomberg REIT Shopping Center Index | 25 | % | 36 | % | 7 | % | ||||||

Bloomberg REIT Index | 19 | % | 66 | % | 34 | % | ||||||

S&P 500 | 16 | % | 61 | % | 9 | % | ||||||

At our 2012 annual meeting of shareholders, our advisory vote on say on pay was overwhelmingly approved by our shareholders, garnering support from 97% of the votes cast at our 2014 annual shareholder meeting supported our say on pay proposal, the meeting. We considered our 2012 compensation programs in light of that vote as well as our evaluation of the effectiveness ofCompensation Committee did not make any changes to our compensation programs in achieving our compensation philosophies. Ultimately we concluded that our compensation programs were accomplishing their intended purpose and as a result, we made no changes to the compensation programs for 2012.plans during 2014.

With respectTotal Direct Compensation:

The following table provides the total direct compensation paid to the compensation of our current named executive officers we tookfor 2014, 2013 and 2012. This chart does not include all of the items required by the SEC to be included in the Summary Compensation Table nor does it calculate the amounts shown in the same manner as the SEC requires in the Summary Compensation Table. The total compensation reflected in the following actions for 2012:table consists of: